Professional Services

Below are all of the services we offer to help transform your business.

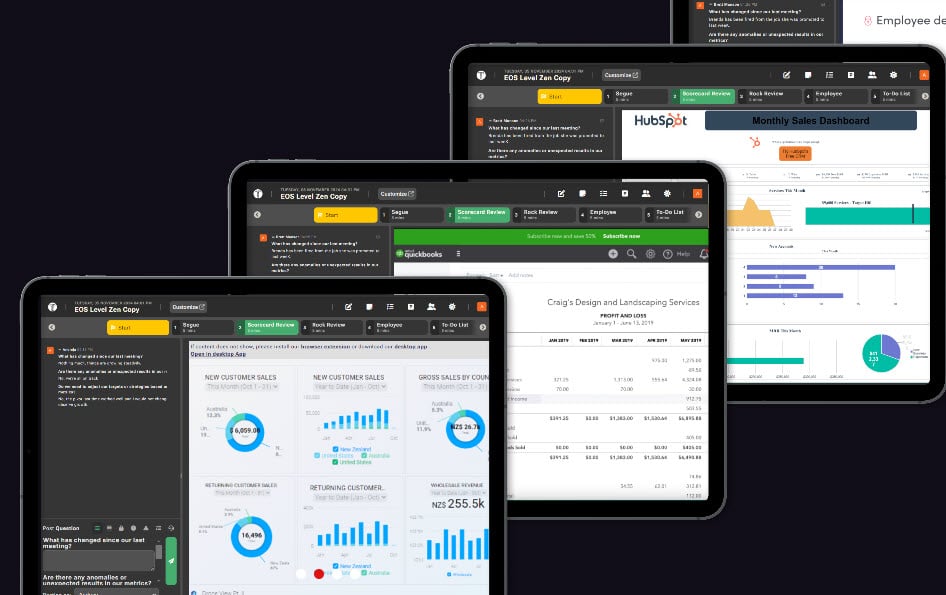

Fractional CFO Services

GAIN AN UNFAIR ADVANTAGE OVER YOUR COMPETITORS

Your expert WAVIA Chief Financial Officer (CFO) will work with you to identify your goals and design a strategic implementation plan. Our process keeps you on track with the support of a customised reporting package so that information is always at your fingertips allowing you to make strategic decisions whilst controlling growth.

It's hard simultaneously juggling all aspects of your business without letting a single ball drop. Whether you're a fresh-faced startup or a well-seasoned professional, the Ignite Finance Team will make sure that you and your business don't miss a step.

23.5% average increase on business performance within the first year of hiring a WAVIA part-time CFO.

Digital Community

Join SingularityU Australia's premier Digital Community, a community of learners passionate about addressing humanity's greatest challenges.

Learning is a continuous journey. We have packaged many opportunities within a single platform including an interactive community feed, Live OnLine workshops, access to the SingularityU Australia Summit 10 content, Webinars, Podcasts, Newsletter subscription and more.

Open your mind to transformative impact. Together we can create #afuturebydesign

R&D Tax Incentive

The Australian Federal Government's Research and Development (R&D) Tax Incentive is a broad based, market-driven program that aims to boost company competitiveness, improve productivity and deliver economy-wide benefits to Australia.

It provides generous benefits for eligible activities in innovation, research and development. So why not have a look to see if your business can benefit from this scheme?

With the R&D Tax Incentive you can claim your business' expenses on innovative activities, scientific research and development of new products & solutions to receive a refundable tax offset of 43.5%.

Start by downloading the R&D Brochure below or get in touch to learn more.

Export Market Development Grant - EMDG

The Australian Federal Government's Export Market Development Grant (EMDG) is a venerable program aimed at expanding to new markets, getting Australian products and services into international markets.

It provides generous reimbursement for eligible activities, such as promoting to international markets, or bringing foreign buyers to Australia. So why not have a look to see if your business can benefit from this scheme?

The EMDG allows you to claim expenses on activities which fall under any of 8 categories which relate to selling products & services to overseas partners, customers and investors to receive a cash reimbursement of up to 50%.

Accounts & Tax Compliance

We believe that accurate data is key to your high level reporting. Our team are trained to ensure data is up to date daily. We'll help with your bookkeeping, accounting and tax compliance. You work on your business, not in it, and we help you do this by specialising in:

- Efficient data entry

- Accounts payable management

- Accounts receivable management

- Stock control

- Fixed asset management

- BAS & Tax advice

- Real time reporting

Get above the day-to-day grind and spend time on what actually matters to you and your business. With our strong practices and timely reporting, we ensure you get the complete picture to make the right financial decisions every moment of the day.

Impact Reporting

Your data is your organisation’s story. Today, the story that your impact data and outcomes tells is growing in importance for all types of businesses. Impact reporting is a primary way to gather qualitative research and tell your audience about the good your company is doing.

An impact report offers businesses a tangible way to communicate the benefits of their efforts to different stakeholders, investors, consumers or people in the community.

This type of report shows what activities and changes a company has made to make a positive impact, whether that’s through sustainability, social justice or community outreach.

An impact report doesn’t simply measure input and output. Instead, impact reports show how the outcomes have produced meaningful change outside of the organisation.

Cloud Bookkeeping Services

Don't let yourself get bogged down & frustrated trying to keep your accounts up to date, let us do that for you while you focus on growing your business, (the high value activity)

For a nominal monthly fee, leverage the power and experience of our world class Accountants team who handle everything you need to keep your books up to date with accurate monthly reporting so you know EXACTLY where your business is at.

We handle your payroll, BAS and Tax returns, Bank reconcilliations, monthly reporting, Xero file and more.

Digital Community

Join SingularityU Australia's premier Digital Community, a community of learners passionate about addressing humanity's greatest challenges.

Learning is a continuous journey. We have packaged many opportunities within a single platform including an interactive community feed, Live OnLine workshops, access to the SingularityU Australia Summit 10 content, Webinars, Podcasts, Newsletter subscription and more.

Open your mind to transformative impact. Together we can create #afuturebydesign

Financial Modelling

Getting this right for any business is often the difference between success and failure. Being able to know where your break even point is, how much runway you have before you need to raise funds, and if you need to, is key. Looking at different pricing models and the impact with a click of a button along with ensuring all the data and assumptions are correct for your financial model is critical for funding, investment and knowing what your ultimate return on investment is.

We have a proven procedure for developing robust financial models for business as we have seen almost every type of buisness available and helped raise millions for businesses.

With our strong Accounting, business and industry experience we ensure you have the right data to make the right financial decisions for your business.

Business Coaching

They say that success in business is 90% attitude and 10% what you actually do.

There are very few business owners, Entreprueners or employees anywhere that have been wildly successful without some kind of coach or mentor.

It can be a very lonely road without the right support, experiene and mindset to make the right decisions and live your best life.

Our Business coaching services and tools will give you the support, direction and plan you need to succeed, and we'll keep you accountable along the way.

Board Services

Our board services help companies improve thier governance, strategy and performance.

Having the right people on a board plays a vital role in the success of any business. It is not always easy to find and secure the right people. We help businesses indentify, attract and onboard the right board members for thier business and use our extensive Wavia Global Community to do so.

For specific businesses, we will also act as Board members, either temporarily or permanently.

We'd be happy to help you get the right board members for your business that add measurable value.

.jpg)

Digital Community

Join SingularityU Australia's premier Digital Community, a community of learners passionate about addressing humanity's greatest challenges.

Learning is a continuous journey. We have packaged many opportunities within a single platform including an interactive community feed, Live OnLine workshops, access to the SingularityU Australia Summit 10 content, Webinars, Podcasts, Newsletter subscription and more.

Open your mind to transformative impact. Together we can create #afuturebydesign